Mike Simons reviewed Microsoft Money Plus Deluxe, version 17.0, specifically for a computer with a Microsoft XP Professional operating system.

He shared why he likes and uses this personal finances and money management software program.

Note: This product is no longer available for sale.

In a nutshell, I have found this program ideal for anyone who wants to manage money and personal finances in the least amount of time possible.

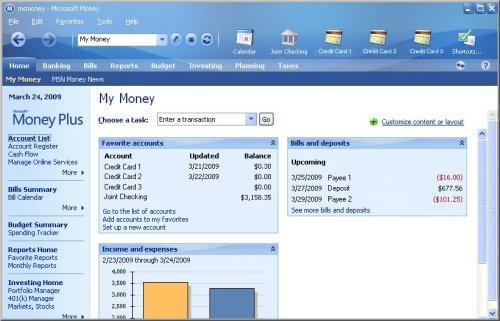

Like many software programs, this one has section “tabs”: home page, banking, bills, reports, budget, planning and taxes. I will cover each of these in depth.

Microsoft Money Plus: Review of the Home Page

- This page is customizable with whatever content you need to see.

- It is easy to eliminate extraneous information that isn’t pertinent for your specific home and budget situation.

- The links at the top and side of the page allow me to get where I need to go really fast, at the click of a mouse.

- The toolbar at the top of the page can be customized with accounts that I regularly use.

- By setting up and using my “Favorite Accounts” window, I can get a really fast snapshot of all of our accounts without having to go to each account page individually.

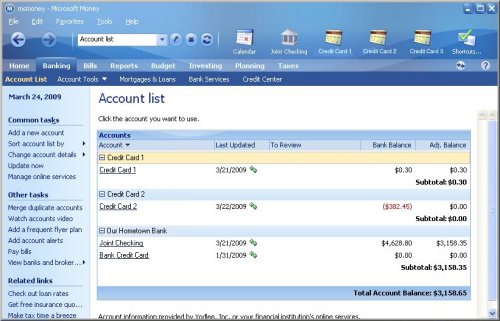

Microsoft Money Plus: Review of the Banking Tab

- I can easily add a new account with the click of a link.

- I can sort our accounts by what’s relevant for my own needs.

- After having set up electronic accounts correctly, I can download account information with no more than two clicks of a mouse via “Update Now.”

- It’s very easy to remove inactive accounts that I no longer want to see.

- I can see our total accounts balances at the bottom of the screen.

- Account names are easy to customize.

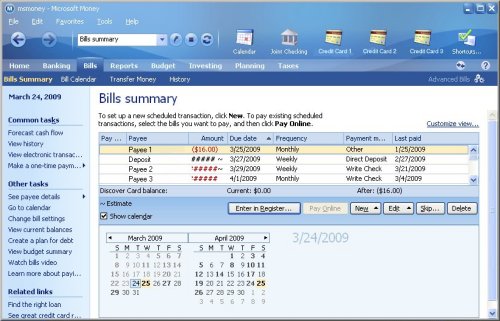

Microsoft Money Plus: Review of the Bills Tab

- I can keep track of bills that need to be paid regularly with the bills summary ledger.

- As I pay a bill, it is automatically added to the correct account that I’ve designated for that expense.

- The bills summary can be customized with the following options:

- to pay online,

- who the payee is,

- the amount,

- the due date,

- the frequency of payment,

- the payment method, and

- when that bill was last paid.

- There are other tasks links that I can use if needed.

Microsoft Money Plus: Review of the Reports Tab

- There are many reports available to enable and empower you to see and understand your current financial situation. Some of these include the following:

- Net worth;

- Credit card debt; and

- Income and expenses by category, payee, accounts, income and spending, annual budget, taxes, and investments.

- A favorite feature of mine allows me to customize and view accounts and import information into Microsoft Excel, which gives us the ability to transfer information into a spreadsheet to ensure that we stay on track for the current month.

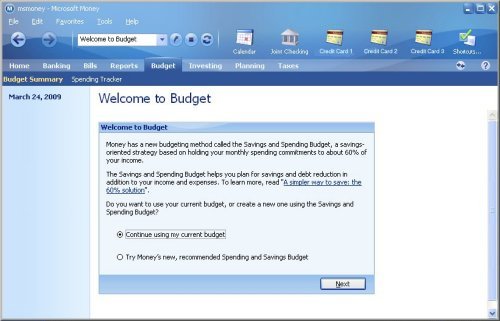

Microsoft Money Plus: Review of the Budget Tab

- This tab enables you to keep track of expenses and income based on what has been entered in the various registers. There was a time when we used this feature but we have found that using a spreadsheet is easier.

- For those individuals needing help and discipline to see where overages in various accounts occur most commonly and are willing to use it honestly, this feature will enable you to decide where to allocate extra funds toward a pet project or item.

Microsoft Money Plus: Review of the Planning Tab

- Although I have not used these features, Microsoft Money Plus helps you in understanding and planning for retirement, savings, college for those who may have younger children still at home, insurance, as well as creating a lifetime planner.

- The lifetime planner enables you to create a comprehensive plan for your financial future, making sure that you can accomplish your financial goals (such as buying a house, paying for your children’s education, and ensuring a secure retirement).

- A debt reduction planner may also be very helpful in taking control in just four easy steps so that your hard-earned money doesn’t go towards interest payments that will never benefit you or your family!

- There is also a link to using the lifetime planner to working with a financial professional.

Microsoft Money Plus: Review of the Taxes Tab

- This link will take you to the MS Money Tax Center so you can view and receive helpful advice.

- The built-in browser feature enables you to view information without needing to open another browser window.

- You can also get information on finding legitimate deductions as well as estimates on whether or not you’ll be receiving a refund for the next tax year.

Microsoft Money Plus: Pros and Cons

These are many wonderful features that I have at my fingertips if I choose to use them. There are a few that I really like to use, so those are what I spend time using regularly. Account setup is very easy to do, which I have found takes five minutes or less to get going.

A nice feature that saves me time is the download feature of account information. When I come home for the weekend, it takes me less than five minutes to handle all the financial details that have been added to our accounts during the last week. This is especially nice for financial investments of stocks, bonds, money market accounts, and the like.

Account balancing takes me less than five minutes total to do each month. It’s important to balance to the penny, so that’s what we do. If there’s a problem, Money alerts me to this and helps me find out where the problem exists.

One disadvantage that Microsoft Money Plus has relates to enhanced security. We have one bank account that has our UserID on one page, but we have to enter our password on the second page in order to gain access to the actual account center. However, this is a minor inconvenience to us as we are able to download directly into Money, and transactions go directly to that account.

Another disadvantage to Microsoft Money Plus can be the information overload. There are so many links and forms available that you can almost drown. However, they are there if you choose to use them. The important thing to remember is that it is up to you to take control of your financial future and to know where you stand, if you will be honest in setting up accounts and common categories. If you don’t find something that you like, you can make one. We have customized our financial data to meet our needs.

The learning curve can seem a little daunting, but once you start working with the program a little at a time, it’s quite freeing! If a family can spend a little time working together, your net worth can grow and debt freedom can become a reality. I used Quicken many years ago but have become accustomed to Microsoft Money Plus. Even if we have to pay for upgrades every 2-3 years, it’s worth the small extra cost to me (about $30). Why? Because I can save time and use that for something else more important. The key is that you find and use desktop financial software that works for you.

Note: Since this page was written, Microsoft Money announced that it was no longer going to service online updates. Personally, we have now started using a different personal financial software program.

![]() Money saving tip: To save money on software that may not be right for you, look for a place where you can download and use the personal finances software on a trial period basis.

Money saving tip: To save money on software that may not be right for you, look for a place where you can download and use the personal finances software on a trial period basis.

Return from Microsoft Money Plus for Personal Finances and Money Management to our Budgeting page or our Truck Drivers Money Saving Tips home page.