There are at least two types of commercial truck leasing:

the kind where a driver (or trucking company) never owns the truck and

the kind where a driver (or trucking company) never owns the truck and- the kind that is known as “lease-to-own” or “lease purchase.”

As always, “the devil is in the details” regarding contracts.

Our Experience

Although we have personally never leased a large truck, Mike has 5 weeks of experience leasing a taxi cab.

Prior to being hired, he had been assured by the owner of the cab company that there was plenty of work.

He was also assured that runs would be split as evenly as possible between the drivers on duty.

Mike was required to sign an agreement that he would:

- pay the cab company $60 per day;

- pay for all of the fuel that he used in the car/van he drove;

- drive a company vehicle;

- work 12-hour shifts; and

- go anywhere the company dispatched him.

Taking All Factors Into Account

When he looked at the amount of money that the cab was supposed to earn per mile (or even smaller parts of a mile) and the pick-up fee, he thought that he would be doing pretty well financially.

However, there were days when he didn’t make enough money to pay the lease, let alone for all the fuel he put in the company car or van he drove.

However, there were days when he didn’t make enough money to pay the lease, let alone for all the fuel he put in the company car or van he drove.

He later learned that the owner of the company was skimming off all of the long runs for himself!

And even though the vehicles were at least somewhat clean, they were older, which meant that they were in the shop more often than newer vehicles.

Basically, the owner of the cab company earned money whether the drivers did or not.

With three vehicles on the road per 12-hour day shift and two per 12-hour night shift (assuming that he had a full contingent of drivers), that was 5 shifts per day during which he was earning $60, meaning that he was making $300 per day!

(Multiply that by 365 days per year and you get $109,500!)

Comparing Objective Factors in Commercial Truck Leasing

There are at least two major factors that must be examined as we compare taxi cab leasing with commercial truck leasing:

- Whether or not the hiring company requires a lease operator to lease one of “their” vehicles; and

- Whether or not the hiring company through which you lease your vehicle also controls your miles (and thus your income).

With respect to the two factors above:

- It is unfortunate that some trucking companies stick their lease operators with equipment that is, as we would call it, a “ragged out piece of junk.”

This kind of truck will have a tendency to break down quickly or stay in the shop more than it runs.

Of course, the lease operator now “owns” the truck and is responsible for its maintenance and repair. - The situation in which a trucking company that holds not only the lease but also your ability to pay your lease can be extremely dangerous.

Is This Program Designed to Fail?

While not all truck leasing outfits are operated in a manner similar to the taxi cab company for which Mike drove, some commercial truck leasing programs are called “lease or fleece” for good reason.

While not all truck leasing outfits are operated in a manner similar to the taxi cab company for which Mike drove, some commercial truck leasing programs are called “lease or fleece” for good reason.

Those programs are the ones that are designed to fail.

They are usually operated by a trucking company with a long history of “fleecing” its lease operators.

This type of commercial truck leasing company does not have drivers’ best interest in mind — or even a win-win situation in mind — when they “rope a driver” into a commercial truck lease.

Of course, it must be said that the driver allowed himself to be roped into the situation.

It is a classic case of being exploited — willingly.

There are commercial truck leasing companies that notoriously shortchange drivers.

We were contacted by someone who objected to an ad on our site because he had been ripped off by the company being advertised. (The ad came up because of the user’s previous preferences.)

Of course, we replied. We wrote in part:

It is an admirable thing to want to become an owner-operator. But one needs to understand the risk involved. Perhaps you were aware of the risk and decided to take it anyway. You admitted, “I fell for their make it big speeches.” Please take a giant step back to understand your own motivation, the goals you set and how you will realistically reach them.

Easy Money?

Take a big step back.

Take a big step back.

Examine your motives.

Before you sign a commercial truck lease because it looks like “easy money,” please be aware that it isn’t.

There is no shortcut to riches in trucking.

It’s hard work.

Money doesn’t just fall into your hands.

In order to earn money in trucking, you have to spend your time, subject your body to the rigors of the road, and be willing to put up with a lot.

(Read our page on how to Become a Truck Driver for more detail.)

Before you sign a commercial truck lease, look for the following (at a minimum):

- truck details (age, maintenance records, etc.);

- truck maintenance details (who pays for what and do you get discounts for getting your truck maintenance done at a terminal?);

- fuel network pricing (do you get discounts on fuel purchased in the network?);

- fuel surcharge;

- per-mile rate (is it enough to pay for your lease and operation of your truck with enough left over to live on?);

- dispatch policy (will you be competing against or with all of the “company drivers” for miles or will you get preferential treatment?);

- guaranteed base pay per week;

- guaranteed number of miles per week;

- layover pay; and

- load refusal policy (if you don’t want to go, for example, to Canada or New York City, can you refuse?).

Our Warning

Why are we going into all of this detail? Because Mike learned the hard way that paying the lease comes first, whether he made money as a cab driver or not.

It was a disheartening thing for him to work for 12 hours straight and realize he wasn’t even earning minimum wage!

It was a disheartening thing for him to work for 12 hours straight and realize he wasn’t even earning minimum wage!

Some days, he paid out more than he earned!

Ramp that up from a taxi cab to a full-size commercial motor vehicle, with commercial truck leasing payments to match!

It can be a very hard pill to swallow.

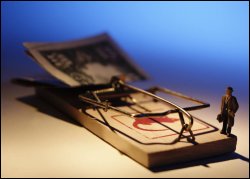

Getting involved with the wrong commercial truck leasing program can be like getting caught in a gigantic money trap.

Many a truck driver has had his dreams of income and owning his own business dashed this way.

As we have written before, the old Tennessee Ernie Ford song “Sixteen Tons” with a miner owing his soul to the “company store” comes to mind.

Still Convinced That You Can Make It?

We recommend that you connect with successful owner-operators who are currently under a commercial truck leasing program and find out how they succeed.

Learn the ins and outs of the business.

Also, read the trucking forums about commercial truck leasing and those who have done it.

Do not think that “your” case is going to be different unless you do things materially different.

We recommend that you read:

- this survey that shows “before” and “after” statistics regarding truck lease purchase programs from TheTruckersReport.com; and

- this article from Allen Smith.

askthetrucker.com/lease-program-for-truck-owner-operators/ (no longer online)

If you insist on becoming a lease driver, we also recommend that you do yourself a favor and lease your truck through a firm that is not connected with your paycheck.

![]() Money saving tip: It can help those looking to become owner-operators if they do not have huge truck payments to make every week or month.

Money saving tip: It can help those looking to become owner-operators if they do not have huge truck payments to make every week or month.

If you can, buy an older and less expensive (but still in good shape) truck. If you can buy it outright, great.

What if you find yourself in a position when you can’t make the payments?

If the company through which you are leasing your truck does not get all of your payments on time, you risk repossession of the vehicle and loss of all of the money you have put into making payments.

What are your legal options if you can’t work? If you do not have the title (because it hasn’t been paid off yet), you cannot sell it.

Can you sub-lease your leased truck?

We cannot emphasize enough that you read and understand everything in the contract before you sign anything.

One of the biggest things to look for is who is responsible for the maintenance and repairs done on the vehicle. If you have to pay for this, the cost would be in addition to your lease payment.

One of the hypocritical things about some trucking companies that lease trucks is for them to say “you own your truck” when it comes to maintenance and repairs, but to hold the title until you have made the very last payment (because you don’t really “own” the truck). Beware of this.

We know that it is impossible to look into the future and see all of the possible events that may take place in your life that can throw you off in your lease payments (sickness, injury, death of a relative, bad weather, truck break down, etc.).

The wise truck driver has an emergency fund and other types of back-up when hard times come.

Beware of “no money down” lease purchase programs. If you don’t have the money to come up with even a down payment toward your truck, you should think twice about whether you will have the financial knowledge to succeed as a leasing owner-operator.

Beware of “no credit check” programs, too. Protect your financial future.

Some owner-operators resent being thrown in the same dispatch pool with company drivers. We can’t blame them because the level of responsibility is completely different.

If you are considering leasing your truck, you might want to consider leasing on with an all owner-operator company. Do your due diligence up-front.

Finally, do not let your “greed” for “being your own boss” or a “dangling carrot” of promised riches get the better of you.

Never under any circumstances should you feel pressured to sign a lease because “the offer only lasts today” or “it’s too good a deal to pass up.”

These are the lines used by those in the timeshare-selling business (where owner dissatisfaction is said to be 97%).

The best thing you can do is simply walk away before you risk damaging or destroying your credit history or your financial future.

Return from Commercial Truck Leasing: Beware of Designed-to-Fail Schemes to our Truck Operations page or our Truck Drivers Money Saving Tips home page.